- #QUICKBOOKS PRO WITH PAYROLL 2012 ANDROID#

- #QUICKBOOKS PRO WITH PAYROLL 2012 PLUS#

- #QUICKBOOKS PRO WITH PAYROLL 2012 PROFESSIONAL#

- #QUICKBOOKS PRO WITH PAYROLL 2012 DOWNLOAD#

Debit card transactions are processed as Signature Debit which does not require entering a PIN code.

Requires QuickBooks Payments subject to application approval. All copies of QuickBooks must be the same version-year. #QUICKBOOKS PRO WITH PAYROLL 2012 PLUS#

Transfer data from Quicken 2016-2021, QuickBooks Mac/Mac Plus 2016-2022 and Microsoft Excel 2013-2019, or Microsoft 365 (32 or 64 bit).E-mail Estimates, Invoices and other forms with Microsoft Outlook 2013 – 2019, Microsoft 365, Gmail™, ®, and other SMTP-supporting email clients.

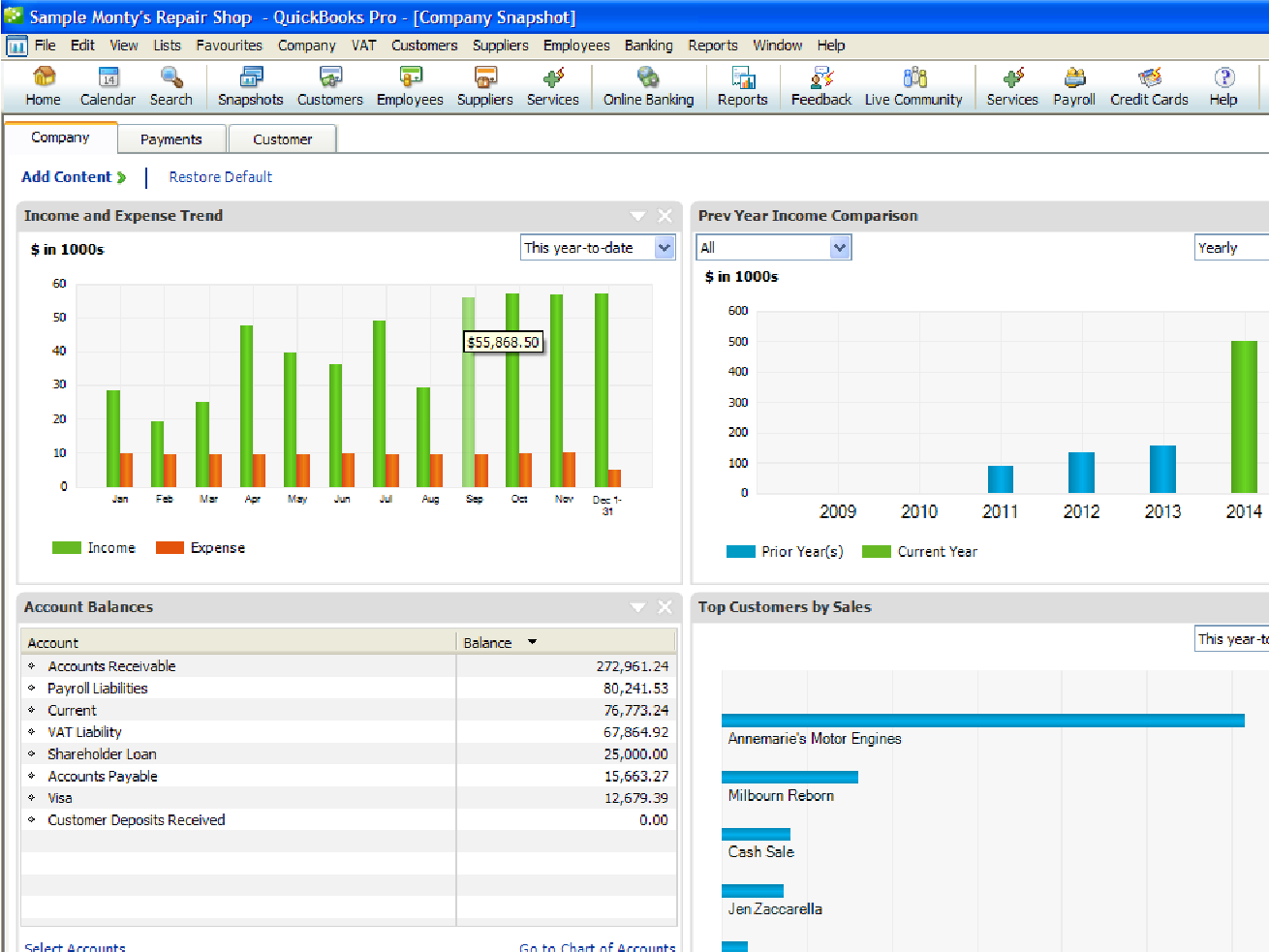

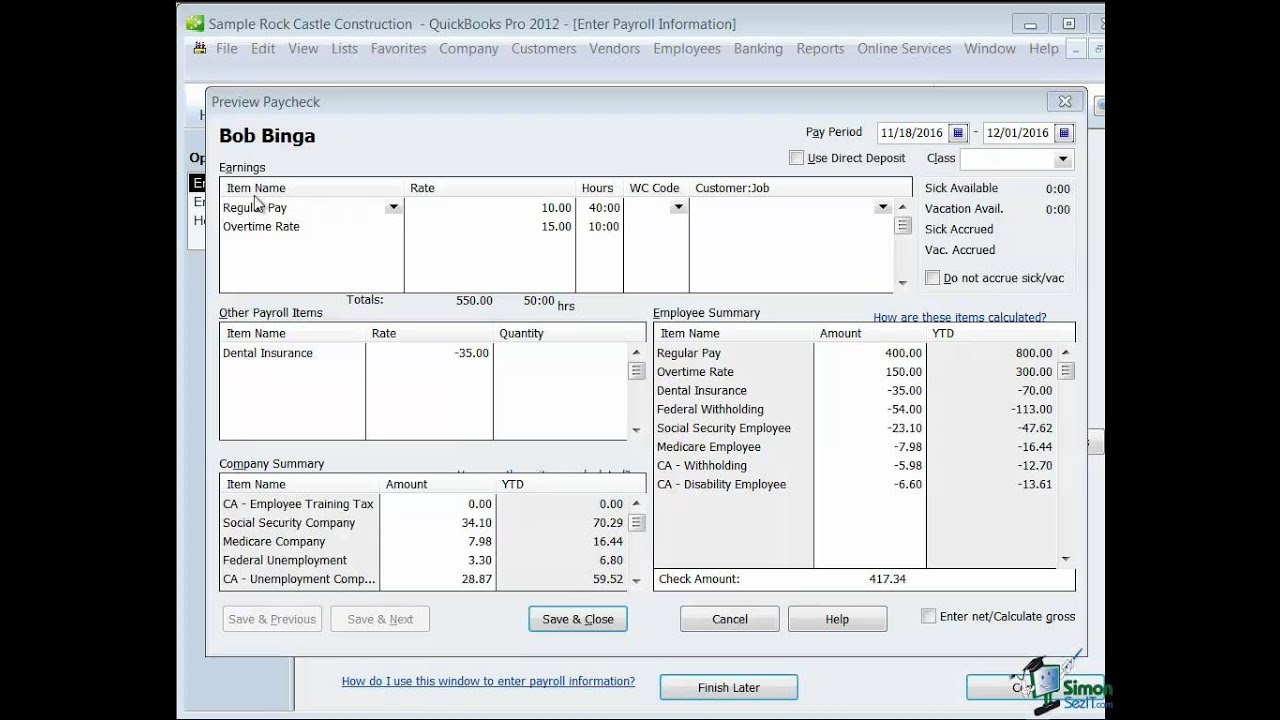

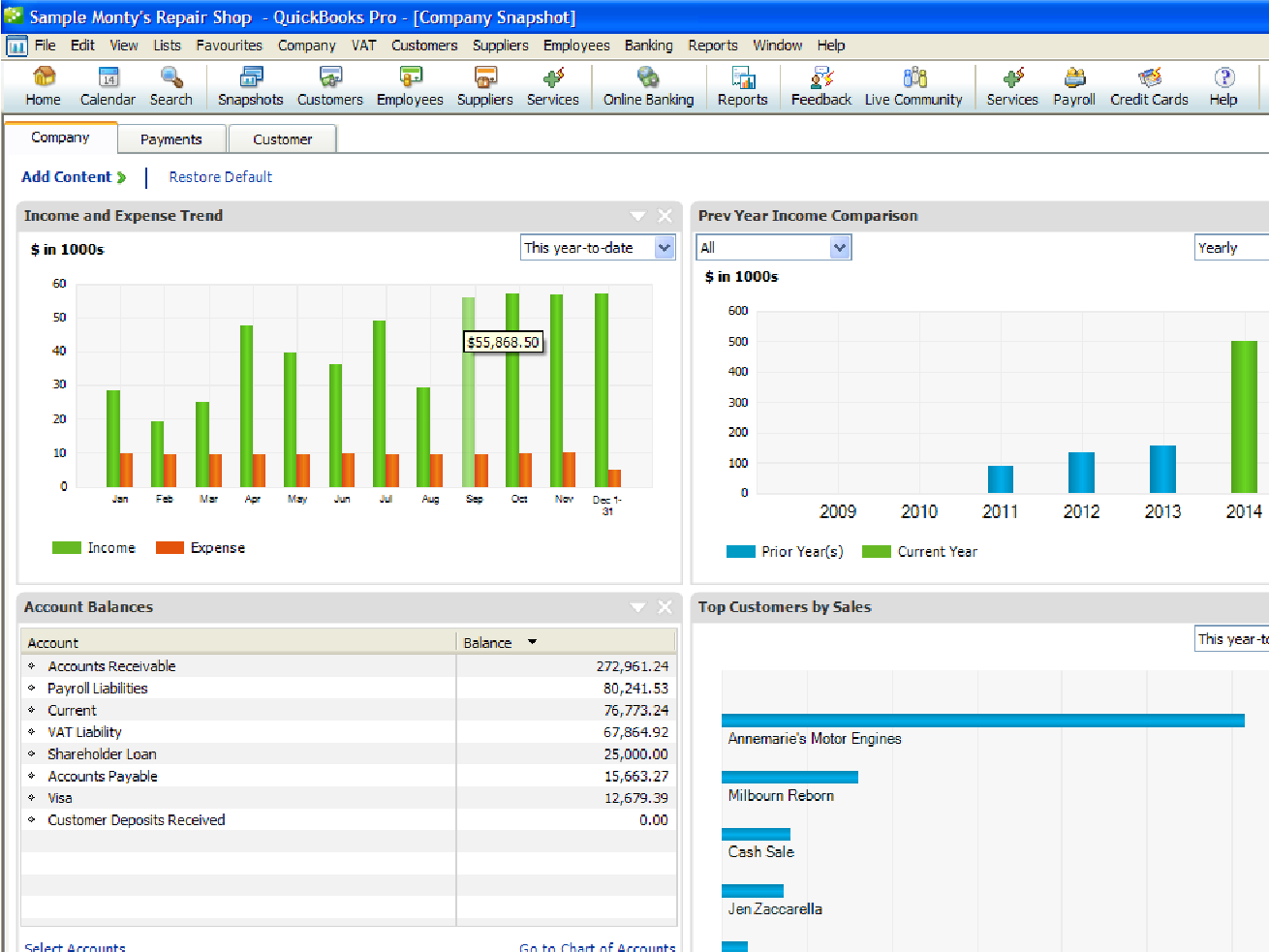

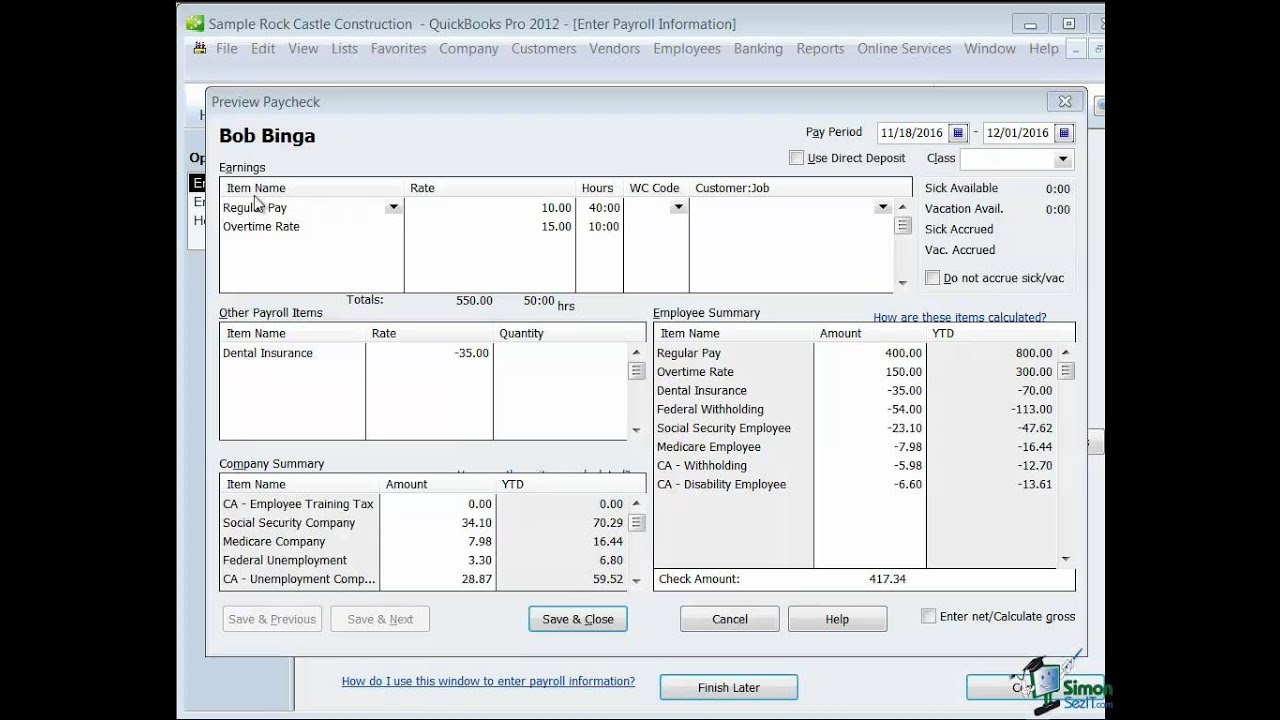

Scheduled reports are not available in Multi-User mode, in hosted deployments, or when there are multiple versions of QuickBooks Desktop installed. Enhanced Payroll subscription required. Available in Basic, Enhanced, and Assisted Payroll Editions. Sick and vacation accrual requirements vary state by state customer is responsible for ensuring compliance with applicable laws and regulations. File size reduced by Data File Optimization feature reduces file size by removing audit trail of historic transactions and a few tables from the database that are not used or needed by the company file. A la carte Annual Care Plan MSRP $299.99. Care plan is included with Plus and Enterprise subscriptions. Access to messaging with live experts or call back support requires a QuickBooks Care Plan, and an internet connection. Hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. Payroll Enhanced for Accountants is a subscription payroll service designed to enhance payroll functions in the QuickBooks Pro and. Available from 6am-6pm Mon-Fri (PST) for Pro, Premier and Plus customers. 2012 Review of QuickBooks Payroll Enhanced for Accountants. Works only with expense receipts, not inventory item receipts.

Scheduled reports are not available in Multi-User mode, in hosted deployments, or when there are multiple versions of QuickBooks Desktop installed. Enhanced Payroll subscription required. Available in Basic, Enhanced, and Assisted Payroll Editions. Sick and vacation accrual requirements vary state by state customer is responsible for ensuring compliance with applicable laws and regulations. File size reduced by Data File Optimization feature reduces file size by removing audit trail of historic transactions and a few tables from the database that are not used or needed by the company file. A la carte Annual Care Plan MSRP $299.99. Care plan is included with Plus and Enterprise subscriptions. Access to messaging with live experts or call back support requires a QuickBooks Care Plan, and an internet connection. Hours exclude occasional downtime due to system and server maintenance, company events, observed U.S. Payroll Enhanced for Accountants is a subscription payroll service designed to enhance payroll functions in the QuickBooks Pro and. Available from 6am-6pm Mon-Fri (PST) for Pro, Premier and Plus customers. 2012 Review of QuickBooks Payroll Enhanced for Accountants. Works only with expense receipts, not inventory item receipts. #QUICKBOOKS PRO WITH PAYROLL 2012 ANDROID#

Must have the QuickBooks Desktop App installed on a camera-enabled mobile device using Android 5.0 (API level 21, Lollipop or onwards), or iOS 12 or later.

Requires a Pro Plus, Premier Plus, or Enterprise subscription. Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions and fees. #QUICKBOOKS PRO WITH PAYROLL 2012 DOWNLOAD#

Customers using QuickBooks Desktop 2022 products may download data from participating banks through the end of May 2025. Cancellation or termination of QuickBooks will not automatically cancel your Webgility subscription You will not receive a prorated refund your access and subscription benefits will continue for the remainder of the billing period. Your cancellation will become effective at the end of the monthly billing period and your subscription will terminate at that time. To cancel your E-commerce subscription at any time, log into your Webgility account customer portal or contact Webgility customer success team at or by call 877.753.5373 ext. Your Webgility account will automatically be charged the package price on a monthly or annual basis, starting at sign up, until you cancel. E-commerce integration subscription will be billed directly from Webgility. E-commerce integration requires an active and current version subscription of QuickBooks Pro Plus, Premier Plus or Enterprise) and a separate Webgility E-commerce account subscription. Additional fees apply when paying with a credit card, or when using optional Fast ACH and Fast Check expedite services. Subscription plans require Internet access, product registration, and an Intuit account.

Offer may not be combined with any other QuickBooks offers. After year one, your debit or credit card account will automatically be charged on an annual basis at the then current annual subscription fee, until you cancel. I'll be around to help you out.Starting from the date of enrollment, receive the price stated above for this year’s version of the product selected if purchased through Intuit. Please know that I'm just a reply away if there's anything else you need.

Click the Green Phone button to get the support number. They can provide you with further details about this concern and provide you the best option for your accounting needs. However, if you need additional assistance with the version that suits your business needs, I'd suggest reaching out to our Customer Care Team. You might also want to check our other QuickBooks versions that can help you run your business easier: QuickBooks products. To learn more about its comparison, please check out this article: QuickBooks Premier. #QUICKBOOKS PRO WITH PAYROLL 2012 PROFESSIONAL#

This can also cater an industry-specific needs, QuickBooks Premier has five editions: Contractor, Nonprofit, Retail, Manufacturing and Wholesale and Professional Services. QuickBooks Premier is a desktop accounting solution that enables users to prints checks, pay bills and track expenses. I can share some insights about the QuickBooks Desktop Premier. Hi there, for reaching back out to us here in the Community.

0 kommentar(er)

0 kommentar(er)